Federal Update

GOP Tax Reform Framework Released – LIHTC included

The “Big Six” – a group of top tax policymakers in Congress and the Administration – released their tax reform proposal today. The Low-Income Housing Tax Credit and the Research and Development Tax Credit are the only two corporate tax expenditures that the framework explicitly preserves. The framework is silent on private activity bonds.Other key features of the plan include:

- Corporate tax reforms

- Reducing the top tax rate for certain pass-through and small businesses to 25 percent

- Allowing immediate expensing of new investments for at least five years

- Partially limiting interest deductibility

- International tax reforms

- Moving from a worldwide to a territorial system to allow companies to repatriate profits without incurring additional taxes

- Subjecting all overseas profits to a one-time tax

- Establishing base erosion rules

- Individual tax reforms

- Proposing unspecific reforms to the Earned Income Tax Credit

- Increasing the Child Tax Credit

- Doubling the standard deduction and eliminating most itemized deductions

- Compressing the current seven individual tax brackets into three

- Repealing the Estate Tax

- Eliminating the individual Alternative Minimum Tax

This begins an aggressive push to pass tax reform on a compressed 2017 legislative calendar. The next step is for the House and Senate to agree to a unified budget resolution with instructions for tax reform. The House may vote on their version this week, with the Senate marking up their budget next week and conference later in October. As the budget process moves forward, the House Ways & Means and Senate Finance Committees (which include Rep. George Holding and Sen. Richard Burr from North Carolina) will work toward agreement on legislative language that fleshes out the Framework’s principles.

Census Data Show Largest Two-Year Income Gain in Five Decades, Progress Against Poverty in 2016

From the Center on Budget and Policy Priorities: Broad growth in jobs and wages in 2016 produced improvements in living standards. The typical household’s income rose by 3.2 percent or $1,800 from 2015 to 2016, after adjusting for inflation, while the official poverty rate fell from 13.5 percent to 12.7 percent. Coming on top of 2015’s progress, this means that over the two-year period from 2014 to 2016, household median income rose quite impressively — by 8.5 percent or $4,600 — while the poverty rate fell by 2.1 percentage points or 6 million people.

National Housing Preservation Database Update

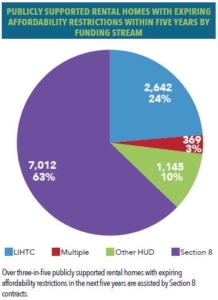

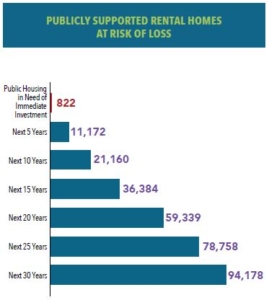

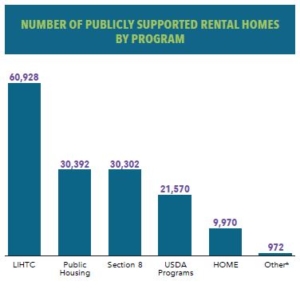

The National Low Income Housing Coalition (NLIHC) and the Public and Affordable Housing Research Corporation (PAHRC) released a major update to the National Housing Preservation Database (NHPD) today. The data shows 11,172 subsidized units coming to the end of their subsidy life in the next 5 years. The NHPD includes data on expiring affordability restrictions for properties supported by HUD Project-Based Rental Assistance, USDA rental housing programs, the Low Income Housing Tax Credit, and other HUD programs. The following links will allow you to register for the NHPD, view an interactive map, and access summary data by state and county.

Enterprise launches Opportunity360

Today, Enterprise launched Opportunity360, a new online platform that measures the extent to which neighborhoods have access to opportunity and helps identify investments that improve lives and communities. Opportunity360 enables users – including investors, people in the housing sector, government officials and others committed to community development – to create one-click Measurement Reports that provide the framework and data necessary to assess both the available pathways to opportunity and the outcomes of opportunity in any neighborhood in the country. It draws on more than 200 indicators organized around five categories – housing stability, education, health and well-being, economic security and mobility – as well as resident feedback aggregated into one web-platform. Visit the Opportunity360 platform to learn more.

State Update

Duke Energy Customers Turn Out to Oppose Rate Increase

At a North Carolina Utilities Commission meeting on Monday, dozens of Duke Energy customers turned out to oppose a proposed rate increase. May cited the impact a fixed rate increase would have on low-income families who pay a disproportionate amount of their income on utility costs. The North Carolina Housing Coalition along with the North Carolina Justice Center, the Natural Resources Defense Council, and Southern Alliance for Clean Energy have partnered with the Southern Environmental Law Center to intervene in the case. Future hearings will be held today in Asheville, 10/11 in Snow Hill and 10/12 in Wilmington. The commission will conduct an evidentiary hearing on 11/20 at 1 p.m. in Raleigh at 430 N. Salisbury Street.

Local Update

Chatham County RFP

Chatham County is soliciting proposals from qualified non-profit developers or qualified for-profit developers for the redevelopment of property to accommodate the high demand for affordable multi-family rental housing developments. All submittals must include two (2) written responses and one (1) electronic copy, and received in the Chatham County Finance Office by 5:00 pm EST on Thursday, October 26th, 2017. Written responses should be delivered to Robin James, 12 East Street, P. O. Box 608, Pittsboro, NC 27312. The electronic copy should be submitted in PDF either on electronic media with the hard copies or e-mailed to robin.james@chathamnc.org. More details can be found here.

City of Wilmington Releases CAPER Report

Recently the City of Wilmington released their draft report on affordable housing. The CAPER (Comprehensive Annual Performance and Evaluation Report) is an annual summary of the City of Wilmington’s progress in meeting goals and objectives established in the City’s Five-Year Plan for use of U.S. Department of Housing and Urban Development (HUD) Community Development Block Grant (CDBG) and HOME Investment Partnership funds and other funds. This year marks the fifth year of a five-year consolidated plan and the report assessed the city’s programs from July 1, 2016 – June 20, 2017. The draft document can be found here.

Reports:

CohnReznick: Housing Tax Credit Investments: High Performance and Increased Need

HUD Office of Policy, Development and Research: Characteristics of HUD-Assisted Renters

Enterprise Community Partners: Encouraging Community Investments through CDFIs: Proposals for a New Federal Tax Incentive

CDFI Fund: New Markets Tax Credit (NMTC) Public Data Release

North Carolina Justice Center: The State of Working North Carolina 2017