This blog post was jointly authored by the NC Housing Coalition and the NC Budget & Tax Center (BTC) a non-partisan organization that works to document fiscal and economic conditions in communities to support the work of people, organizations, and government to advance solutions to poverty and pursue racial equity.

In every county and every neighborhood in North Carolina, people need safe homes for themselves and their families where they can afford to pay their rent or mortgage without cutting back on other needs like healthy food or doctor’s visits. State funding for affordable housing can help make this a reality, and the NC Housing Trust Fund (HTF) is one the best tools that North Carolina has to support a variety of housing needs across the state.

The Housing Trust Fund (HTF) was created by the General Assembly in 1987 and is administered by the North Carolina Housing Finance Agency. It is by far one of the most flexible and critical housing resources for the state’s growing and complex affordable housing needs. Every dollar allocated to the HTF goes directly into financing the brick and mortar development of affordable rental housing, supporting affordable homeownership, emergency repairs and accessibility modifications, emergency housing, and providing housing for people with disabilities. Every $1 million spent from the HTF assists an estimated 108 families.

Since 1987, the NC Housing Trust Fund has helped finance over 41,030 housing units. And for every dollar the HTF spends on housing North Carolinians, it leverages $4 from other sources. (NCHFA)

Inadequate funding means the Housing Trust Fund isn’t as effective as it could be

Despite the demonstrated impact of the HTF, the rising costs of housing, and inflation, state legislators have not meaningfully increased funding for the HTF since its creation more than 35 years ago, especially when adjusted for inflation.

Instead of funding the affordable housing that our communities need, leaders in the General Assembly have chosen over the past decade to prioritize income and corporate tax cuts that primarily benefit wealthy people and profitable corporations in our state. These tax cuts slash our state’s revenue and mean less funding is available for key needs like housing. By choosing to put only small amounts of state funding in the Housing Trust Fund, and having no dedicated revenue source for affordable housing, legislators have hindered North Carolina’s ability to invest in affordable housing at a scale that meets our needs.

This is why the NC Housing Coalition, for decades, has advocated for funding the HTF at higher recurring levels and for identifying dedicated funding streams. Bills like SB424: Restore the American Dream offer a promising model. This bill would allocate an additional $30 million in one-time funds to the HTF in the 2023-2024 Fiscal Year and identifies two dedicated revenue sources for future funding above and beyond General Fund allocations. Unfortunately, the bill has not moved forward during this legislation session, but a look at how legislation like this could have funded the HTF over the past five years shows its potential.

Dedicated funding streams could expand the Housing Trust Fund’s impact

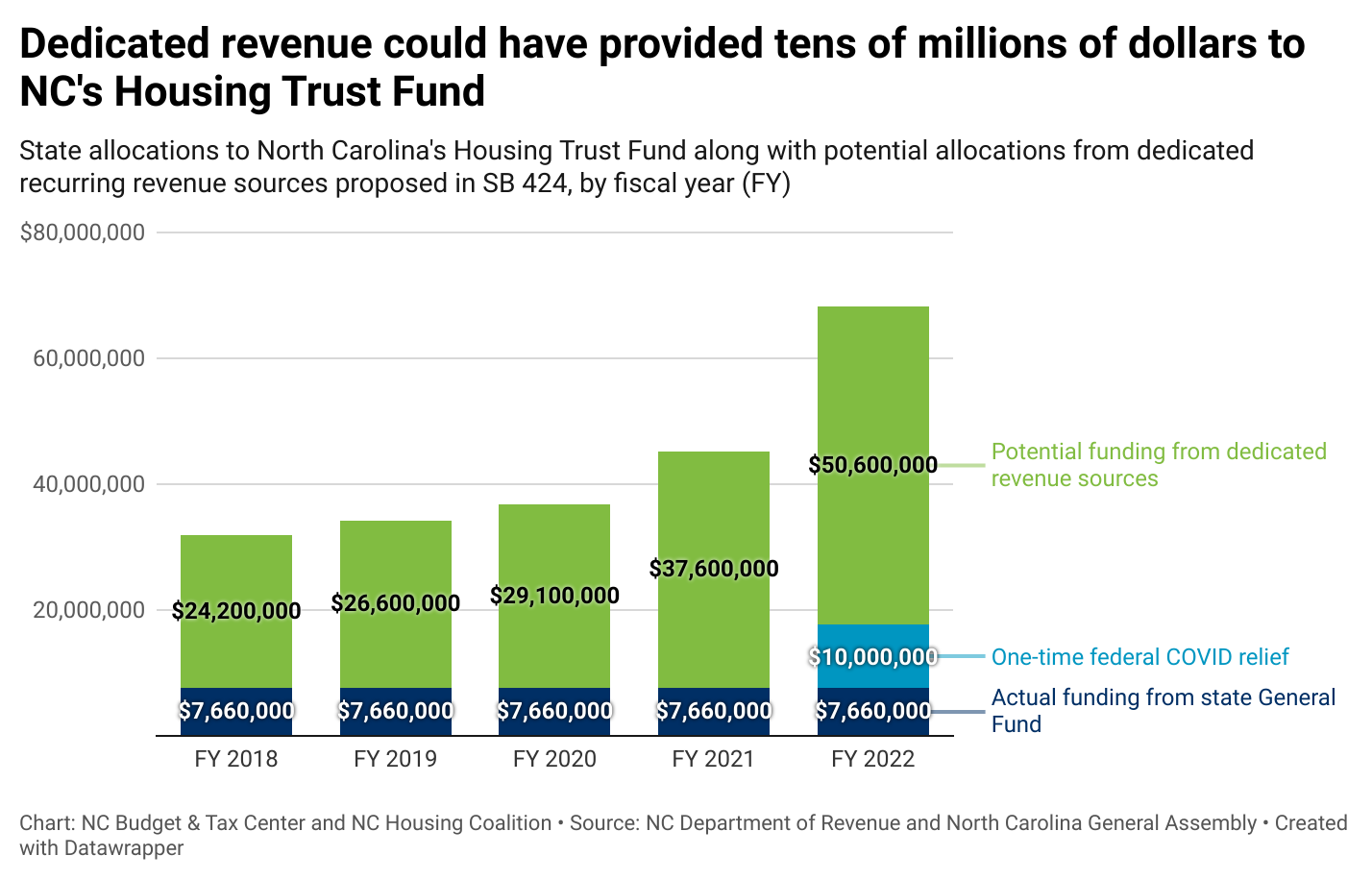

In addition to allocating $30 million in non-recurring funds to the HTF, SB424 proposes using a portion of the state’s revenue from two sources related to real estate sales. The first is the deed of trust or mortgage fee, paid whenever a new mortgage is recorded. The second is an excise tax (sometimes referred to as a real estate transfer tax), which is paid whenever a person or company purchases real estate and is based on the value of the sale. Counties already collect these fees, and they keep a majority of the revenue for local services. Each month they also send a portion of the money they collect to the state. Under SB 424, part of the funds that go to the state from each of these sources would go directly to the HTF. By reviewing past data on what the state’s General Fund received from these sources, we can estimate how much money could have been invested into affordable housing if the policy had been in place for the past five years.

The chart below shows that in the 2021-2022 Fiscal Year (FY 2022), the HTF would have had an additional $50.6 million to meet community housing needs. (Note that the chart doesn’t distinguish which portion comes from deeds of trust or mortgage fees vs. the excise tax, but the excise tax is a much larger funding source and would provide over 99 percent of the funding.)

Datawrapper version: https://www.datawrapper.de/_/n4cuc/

Datawrapper version: https://www.datawrapper.de/_/n4cuc/

Dedicating a portion of state revenue from these two sources would have provided $168 million to support safe, stable, and affordable housing across the state over the past five years, above and beyond what was budgeted from the general fund.

Key Takeaways

Takeaway 1: The HTF needs to be funded at higher levels to meet the scale of the need AND needs a dedicated revenue source. The North Carolina Housing Coalition advocates for the General Assembly to fund the HTF at a minimum of $70 million annually

Takeaway 2: Instead of funding the affordable housing that our communities need, leaders in the General Assembly have chosen over the past decade to prioritize income and corporate tax cuts that primarily benefit wealthy people and profitable corporations in our state. These tax cuts slash our state’s revenue and mean less funding is available for key needs like housing.

Takeaway 3: We have already missed out on almost $170 million that could have gone to affordable housing in North Carolina over the past five years.

Takeaway 4: Despite rising housing costs and inflation, funding for the Housing Trust Fund has remained flat. If funding was restored to original levels from the program’s creation in 1987, it would amount to $54.5 million annually when adjusted for inflation.

As federal funding for affordable housing has consistently declined over the last several decades, and state funding remains inconsistent or insufficient, more and more pressure is placed on local communities across the state. As our affordable housing crisis continues to grow and deepen, investment in housing at all levels is critical.

Your voices matter — now is a perfect time to call, email, or write to your state senators and representatives. Ask them to fund the Housing Trust Fund at $70 million with recurring dollars for Fiscal Year 2023-24 and Fiscal Year 2024-25. Tell them the importance of dedicated revenue sources for the HTF and why affordable housing matters to you and your organization and community.

For a deeper look at this analysis done in collaboration with our brilliant partners at the NC Budget & Tax Center, stay tuned for our joint policy brief that will be released later this month.

Sources:

US Bureau of Labor & Statistics CPI-U Inflation Calculator

NC Housing Finance Agency

Ncleg.gov