Since its introduction last year, the Affordable Housing Credit Improvement Act of 2023 – or AHCIA 2023 – has received historic levels of bipartisan support, and two of its provisions made it into the tax package passed by the House: Tax Relief for American Families and Workers Act (H.R. 7024). Since September 2023, there have been over 4 Continuing Resolutions (or CRs) passed while Congress debated and deliberated over the final spending package for Fiscal Year 2024. On March 22, 2024, Congress passed the last six spending bills needed to complete the budget process for Fiscal Year 2024 (FY24). That same week, President Biden released his proposed Fiscal Year 2025 (FY25) budget. And the following week on March 29, 2024, a federal judge in Texas issued a preliminary injunction on the implementation of the new CRA regulations. This roundup will provide an overview of the latest federal policy and budget news with opportunities for advocacy and engagement.

AHCIA 2023 Provisions in H.R. 7024 – Tax Relief for American Families and Workers Act

As of the end of March 2024, over 47 percent of Congress cosponsors the legislation, and that is divided evenly by party. The total number of House representatives that are cosponsors is 220, and in the Senate, the latest number of cosponsors is 34.

Two provisions inspired by the AHCIA 2023 were included in H.R. 7024 which was passed by the House in January and sent to the Senate on February 7. The first provision restores the 12.5 percent cut to the 9 Percent Housing Credit, and the second lowers the bond financing threshold to 30 percent in order to support increased production using the 4 Percent Housing Credit. Since it has reached the Senate, it seems to be at an impasse; however, the reasons seem to have nothing to do with the provisions inspired by the AHCIA, but rather the details surrounding the proposed expansion of the Child Tax Credit. As more time passes, advocates are worried that this opportunity to boost the Housing Credit will pass and delay a much needed improvement to our country’s largest tool for affordable housing preservation and development.

Journey to the FY24 Federal Budget

During June of last year, as we approached the end of the federal fiscal year (September 30, 2023), the early editions of proposed spending bills, especially around housing and community development, were particularly troubling. One version of proposed topline allocations from the House proposed cutting more than $22.12 billion from the Transportation, Housing, and Urban Development (THUD) spending bill, and would have resulted in a cut of more than 25 percent from FY23-enacted levels. A few months prior, in April 2023, House Republicans pushed for cuts in their “Limit, Save, and Grow Act” which would have resulted in nearly 1 million households losing their housing assistance.

Also in June 2023, the passage of the “Fiscal Responsibility Act” (FRA) severely limited funding for domestic programs such as affordable housing and homelessness. Under this deal, overall spending for domestic programs is capped at FY23 levels and increases in FY25 are limited to only 1 percent in exchange for raising the federal debt ceiling. An additional $69 billion side agreement was negotiated in order to support funding for domestic programs. And at the same time, the Department of Housing & Urban Development’s (HUD) budget for FY24 was under additional strain due to the high renewal costs for vouchers caused by the substantial increased cost of rent in communities across the country, as well as lower than expected receipts from the Federal Housing Administration (FHA), which are typically used to offset the cost of HUD programs.

On March 3, Congressional Leaders released a final fiscal year (FY) 2024 Transportation, Housing, and Urban Development (THUD) spending bill that, despite initial fears and significant funding challenges earlier this year, provides an increase for HUD’s affordable housing and homelessness programs:

To view an overview of the FY24 spending bill, click here. Some highlights of the final spending bill include the following:

- $32.4 billion for the Housing Choice Voucher (HCV) program = increase of $2.1 billionThis should allow for sufficient resources to renew all existing rental assistance contracts and expand rental assistance to an additional 3,000 households. Without this increase, or if the funding levels had remained at the level proposed in either the House or Senate versions presented earlier in the year, this could have led to a loss of 80,000 to 112,000 housing choice vouchers according to the Center on Budget and Policy Priorities.

- $4.05 billion for The Homeless Assistance Grants program = increase of $418 million.

- $3.41 billion for The Public Housing Capital Fund = increase of $30 million

- $5.5 billion for The Public Housing Operating Fund = increase of $367 million

- $1.1 billion for The Native American Housing Black Grant Program = increase of $324 million.

- $20 million for The Eviction Prevention Grant program = level funding.

- $16 billion for the Project Based Rental Assistance program = increase $1.1 billion.

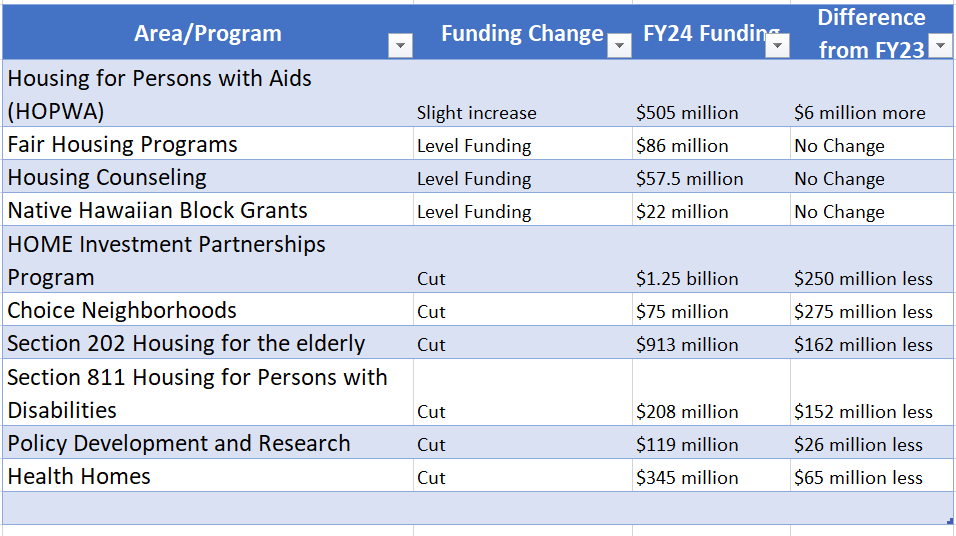

Not all programs received significant increases, some were cut, or kept the same.

Proposed Fiscal Year 2025 Budget

On March 11, 2024 President Joe Biden and former HUD Secretary Marcia Fudge released their FY2025 budget request, which proposes $72.6 billion – level funding – compared to FY24 – through the appropriations process for affordable housing and homelessness programs. This level funding proposal is due to the restrictions from the spending caps agreed to by Congress and the White House under the Fiscal Responsibility Act of 2023, which only allows for a spending increase of 1% in FY25 compared to FY24. An additional $258 billion outside the appropriations process for affordable housing is proposed via mandatory spending. For NLIHC’s FY25 Budget Chart for Selected Federal Housing Programs, click here.

Overall, despite the strict spending limits, the budget proposal calls for an increase in funding for Housing Choice Vouchers to $32.8 billion and Project-Based Rental Assistance to $16.7 billion to renew rental assistance for current households, as well as additional modest increases in funding for other programs such as the Homeless Assistance Grants, Section 202 Housing for the Elderly, Section 811 Housing for Persons with Disabilities, and more.

Several other programs in the proposed FY25 budget would unfortunately receive cuts, some of those programs include:

- Public Housing Capital Fund

- Native American Housing Block Grant

- CDBG program

Challenges ahead for Housing & Homelessness Programs in FY25 Budget

There are many challenges ahead for the FY25 budget due to the divided congress. Despite the proposed increases in President Biden’s budget, the $32.8 billion for Housing Choice Vouchers, and $16.7 billion for Project-Based Assistance may not be enough to renew all of the current housing vouchers due to the continued rise in the cost of living. Additional funding may be needed to ensure that housing vouchers are not lost.

Now that the FY25 appropriations cycle has officially begun, over the next few months, Congress has to finalize this process and enact a Continuing Resolution (CR) by October 1 when the new fiscal year starts to avoid the risk of a government shutdown.

Advocacy & Engagement Opportunities

There are several opportunities for advocacy surrounding these federal budget and policy matters. There are two main areas where advocacy and engagement is still incredibly necessary.

Issue: Fiscal Year 2025 (FY25) Spending Bill for THUD

- Start now! Contact your members of Congress and:

- Urge them to support the highest level of funding possible for HUD’s housing and homelessness programs in FY25.

- Use any of the templates from the National Low Income Housing Coalition (NLIHC), find them by clicking here.

Issue: Critical Housing Credit Provisions from AHCIA 2023 must pass this year, and soon!

- Reach out to your members of Congress, especially your Senators, or leadership that can emphasize the importance of ensuring the AHCIA 2023 provisions included in the Tax Relief for American Families and Worker Act pass before there are no other legislative vehicles to tie them to.

- Use these factsheets and letter templates from the ACTION Campaign to help craft your messaging and direct your communications about why the Housing Credit matters to North Carolina and our entire country during a time of immense affordable housing need.

If you have any questions, feel free to reach out to Stephanie Watkins-Cruz at swatkinscruz@nchousing.org.