By Stephanie Watkins-Cruz and Anna Patterson

On Wednesday, June 14,the National Low Income Housing Coalition released the 2023 Out of Reach (OOR): The High Cost of Housing report. This annual report is filled with critical data that highlights the mismatch between the wages people earn and the cost of housing at fair market prices across every state, county, non-metropolitan, and metropolitan area across the United States. One of the ways this is done is by the establishment of a “housing wage” for each area. The housing wage is an annual estimate of the hourly wage full-time workers must earn to afford a rental home at fair market rent without spending more than 30% of their incomes.

This year, in addition to the housing wage data, NLIHC also highlights the impacts of rising and unaffordable rents with the expiration of many pandemic-era safety net programs and policies, further exacerbating the instability that many low-income renters already face.

Out of Reach at the National Level

Across the country, a renter needs to earn $28.58 per hour to afford a modest two-bedroom rental home without spending more than 30% of their income on housing costs, or $23.67 per hour to afford a one-bedroom home. While the Housing Wage varies by state and metropolitan area, low-wage workers everywhere struggle to afford their housing.

In no state, even those where the minimum wage has been set above the federal standard of $7.25, can a minimum-wage renter working a 40-hour work week afford a modest two-bedroom rental unit at the average fair market rent.

The highest state housing wage in the country is California, where a renter must earn $42.25 per hour to afford a modest two-bedroom rental home.

The lowest state housing wage in the country is Arkansas, where a renter must earn $16.27 per hour to afford a modest two-bedroom rental home.

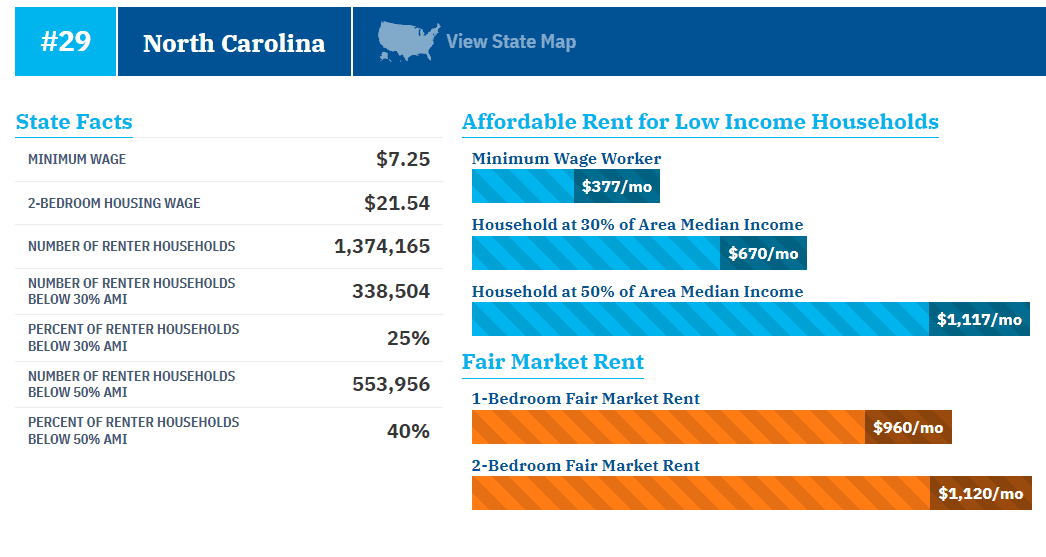

Out of Reach in North Carolina

This year North Carolina’s housing wage is the 29th highest in the nation at $21.54/hr, which is the housing wage needed to afford a 2-bedroom at fair market rent. This means someone earning minimum wage – $7.25/hr – would have to work at least 119 hours to afford a 2-bedroom home at fair market rent, or have 3 full-time jobs.

Stay tuned for next week’s Housing Call, where we’ll dive into North Carolina-specific data and take a look at how things have changed since last year’s OOR report.

For more information about housing affordability in North Carolina, check out our 2023 County Profiles by clicking here.

To view the full 2023 Out of Reach report click here.

To view the 2023 Out of Reach report profile for North Carolina click here.