A homeowner living in a historically Black neighborhood in Southeast Raleigh contacted me last week, shocked because he had just received his new property tax valuation from Wake County. His tax value had increased from $175,000 to $310,000, an over 75% jump. Could this be right? What would this mean for his taxes? What options does he have to challenge this?

Wake County recently released its 2024 property revaluation, its first revaluation in four years. Initial data shows a 53% increase in overall residential property value, a massive rise from the previous revaluation. To translate that, a homeowner with a previously assessed value of $200,000 experiencing the county’s average residential increase would now have a home with a tax value of $306,000. The increase in average valuation is relatively consistent across major jurisdictions, ranging from 44% in Morrisville and 48% in Raleigh to 56% in Apex and Garner, 58% in Holly Springs, and 65% in Rolesville (Breakdowns by municipality, including ones with small amounts of property are available here). As a result, many residents are paying more attention than usual to the revaluation. What impact might this increase have on property taxes?

This post will provide some context for the implications of a revaluation on property taxes, focusing on Wake County’s. It will also highlight why it’s just as important for residents in other counties that have revaluations with less dramatic increases to pay attention to their new valuations and to know what tools and options they have for understanding and appealing their values.

Revaluations Across the State

24 of North Carolina’s 100 counties have new property revaluations effective as of January 1 of this year (see if your county is one of them here). During a revaluation year, a county’s tax office revalues all real estate property: county appraisers use recent sales data, property information, and variety of appraisal methods to complete a mass assessment of residential and commercial property, adjusting all county property values as close to “market value” as the County can estimate effective January 1 in a revaluation year – with the purpose of having values and taxes be more fair and equitable.

By state law, all properties are supposed to be valued at their market rate – and taxed accordingly. But North Carolina counties only conduct property revaluations every 4-8 years, much less frequently than in most other states. As a result, these revaluations often result in:

- Massive shifts in property values, like those in the Wake County revaluation, that seem all at once but instead may reflect cumulative changes over several years.

- Drastic impacts on the distribution of the property tax burden in a county for at least the next four years. In other words, valuations help determine the proportion of your county and city’s property taxes you will contribute until the next revaluation: property owners – and neighborhoods – that see higher value increases than the county/city average increases will be paying a higher proportion of the county/city property taxes the following years, or have a larger piece of the area’s property tax burden. In Wake County’s 2020 valuation, for example, many neighborhoods in Southeast Raleigh experienced a far larger average increase in value than the county-wide average, resulting in a substantial increase in property tax burden for many homeowners across those neighborhoods.

Why does this matter?

Revaluations are critical times for homeowners to make sure their values are accurate and equitable – and to appeal if not. Recent property tax equity analysis of North Carolina showed that properties in lower income communities across the state are often systematically overassessed compared to higher value properties – and that owners of the lowest price housing in some counties are paying nearly double the property taxes of the owners of the highest-price housing per dollar of market value. The disparities are most extreme in smaller counties that often have less capacity and resources for property assessments. Despite this disparity, an analysis of property tax appeals in Mecklenburg and Durham counties showed that owners of high value properties are about four times more likely to appeal than the owners of the lowest-value homes, resulting in a lower tax burden for high-value homes.

In the Triangle – especially in Wake County recently – the revaluations have been more equitable than in most counties in NC. But even mass assessments that score well in county-wide equity metrics can mask inequities within quickly gentrifying neighborhoods, where newer, larger, higher-cost homes can be undervalued while long-term neighbor homes, often multi-generational Black-owned homes, can be overvalued and overtaxed. Here’s an example from a historically Black neighborhood in Chapel Hill in which hundreds of older, smaller homes had been overassessed before the community successfully mobilized neighborhood-wide appeals:

Credit: Marian Cheek Jackson Center, from an online “quiz” that showed assessment comparisons in the Northside neighborhood of Chapel Hill.

Credit: Marian Cheek Jackson Center, from an online “quiz” that showed assessment comparisons in the Northside neighborhood of Chapel Hill.

And even when there’s not a neighborhood-wide problem, a mass assessment is impacting hundreds of thousands of properties, so there will be mistakes or things the county did not know when it made its revaluation. In other words, it’s important to pay attention and help your county get it right!

How will this impact my property taxes?

Across Wake County, many homeowners are wondering what such a substantial property value increase will mean for their property taxes: will this increase my property taxes?

The best answer to this question is that it depends on both the extent of the individual property valuation increase AND the county and relevant local tax rates that will be set in June.

Here is a breakdown of how:

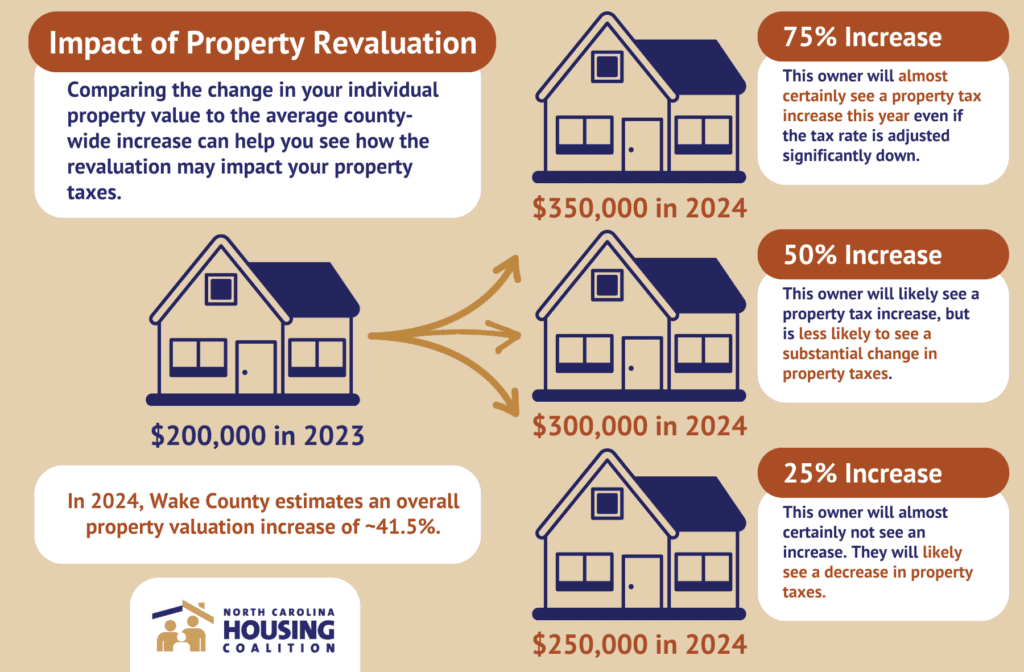

First, it will depend on the extent of your property’s value increase in relationship to to the overall increase in your city’s and Wake County’s total tax base. Revaluations primarily impact the distribution of the property tax burden across a county and city. Given values for both commercial and residential properties rose so substantially across the board in Wake County, a rise in values will not necessarily mean a rise in taxes: it will depend on the extent of that value increase as a proportion of the whole (and in relation to the tax rate, to be discussed next). Owners in Wake who see an increase close to the estimated overall tax base increase (~41.5%) are less likely to see a substantial change in property taxes. Meanwhile owners of homes with a higher-than-average increase will almost certainly see a property tax increase, while homes with a lower-than-average increase may even see a property tax decrease this year.

Second, it depends on the tax rate. If both Wake County and your city lower their tax rates in June to a revenue-neutral tax rate (functionally meaning average rises in value would be off-set by a tax rate decrease), then an average value increase would not result in major property tax changes. That said, counties and local city governments can and often do choose to capture some of that increase in value when they set their tax rates in order to support additional priority expenses. If that were to happen, then a larger proportion of property owners would experience an increase in property taxes.

Wake County has a nifty tool called the “revenue neutral calculator” that shows your property’s increase in value and the impact of the valuation on county taxes were Wake County to make their tax rate “revenue neutral.” If this calculator shows a potential increase in property taxes, it is extremely likely your property taxes will increase. If it shows consistent or lower taxes, your property is far less likely to experience a substantial increase in property taxes.

No matter what, it’s important to make sure that your property has been valued fairly and equitably – and to appeal if it seems it hasn’t been. You can see comparable homes that were used to help establish your home’s new value by typing your address into another Wake County tool.

What can homeowners do? Key things to know about property valuation appeals.

All property owners have the right to appeal their property valuation. Wake County is accepting informal appeals until March 1 and formal appeals from March 2-May 15. Other counties will have slightly different timelines and these should be listed on your valuation notice and on your county’s revaluation site. Here are the options Wake County gives for their appeals.

Appealing a valuation can seem like a significant undertaking, especially for those without significant real estate knowledge. Here is some information intended to clarify the process, especially for those who have not considered appealing before:

- Appeals are free (or can be if you don’t pay somebody to do them!).

- Appeals do not require attorneys or people with real estate expertise. In fact, any homeowner in a county can appeal any property’s value in that county. And while it can help the chances of your appeal to follow your county’s stated process and provide reasons for your appeal (missing information, property comparisons, etc.), legally, a property tax appeal can be as simple as an email to the tax office saying you are appealing the value of a specific property for being too high (or too low).

- Each county offers a window for informal appeals and formal appeals. Wake County’s site explains the differences in those processes here.

- Your knowledge of your home and neighborhood homes is an asset. Assessors don’t have the right of entry in North Carolina, so they are often working off limited information on the interior conditions of homes. If you know things about your home that differentiate it from homes nearby that have sold (for example: your home hasn’t had major renovations in several decades compared to the recently renovated home that sold across the street), that information could be used in your appeal.

- Appealing does not require you to allow a county appraiser into your home. You can choose to allow county appraisers to see the inside if you believe it strengthens your appeal (and in some cases, it can), but an appeal does not require it.

- Successfully appealing a property valuation does not hurt your market value; it impacts your tax burden. Property tax values follow the market; they don’t create it. Market value is also constantly changing across time, while NC revaluations hold for 4-8 years. For this reason, property tax values almost always lag behind a strong market. If lowering your tax value impacts the home’s market value, why are the owners of the highest value properties the most likely to appeal for their values to be lowered?

Counties expect a significant number of appeals during a revaluation year (Wake is expecting ~30,000), and it’s important that all property owners know they have this option, even if they choose not to pursue it.

County revaluations can have a major impact on property taxes, especially given how spread out they are in North Carolina. The SE Raleigh homeowner mentioned at the beginning of this post will almost certainly see a property tax increase in the coming year if his valuation holds. In this case, his increased share of Wake County’s property tax burden will be in place for the next four years until the next revaluation. His value may be fair and reflective of comparable home sales around him, but at the very least, it’s important for him to explore whether that’s true and to know his options to have it corrected if not.

For more information:

Wake County Revaluation Website

Wake County Appeals Information

Wake County’s new portal to explore comparable sales

Wake County’s Revenue Neutral Calculator (description with link at bottom to tool)

Article about property tax appeal disparities with links to county studies referenced in this paper

A Study of NC Property Tax Equity with policy suggestions

Marian Cheek Jackson Center Property Tax Advocacy Page

National Property Tax Equity Analysis with County-level Data