Earlier today, Treasury released new guidance on the use of State and Local Fiscal Recovery Funds (SLFRF) to fully finance long term affordable housing loans. This announcement comes after a final rule released in January 2022 failed to address this gap. Since then, states and localities had been unable to use recovery funds for housing financing, particularly for LIHTC loans with maturities beyond 2026.

North Carolina was one of approximately 20 states that allocated a portion of these funds to affordable housing by appropriating $170M to the Workforce Housing Loan Program. Due to the Treasury barrier, these funds were not able to be deployed and the General Assembly swapped out the recovery funds with state funds.

In March, members of North Carolina’s congressional delegation introduced the LIFELINE Act as a legislative fix, but the bill has not advanced. The new guidance incorporates measures from the LIFELINE Act into Treasury’s policy.

Treasury partnered with HUD to create a SLFRF Affordable Housing How-To Guide that outlines important components of the guidance released this morning:

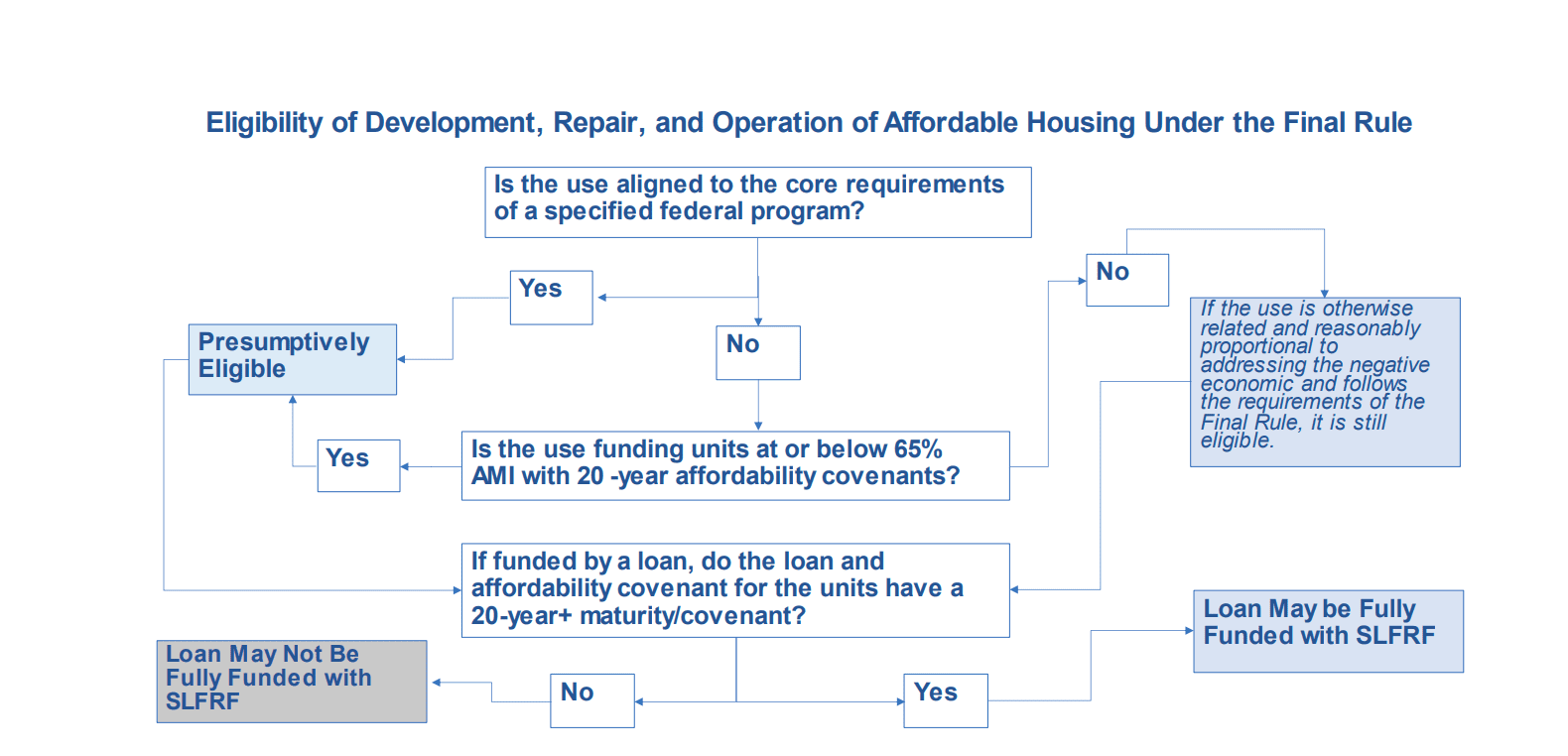

- Increases flexibility to use SLFRF to fully finance long-term affordable housing loans. The guidance achieves what the LIFELINE Act sought to do by allowing governments to use SLFRF to fully finance long-term affordable housing loans, including the principal of such loans, subject to certain conditions.

- Expands presumptively eligible affordable housing uses to further maximize the availability of SLFRF funds for affordable housing. Treasury’s Final Rule allowed for flexibility in the use of funds for affordable housing, identifying uses consistent with HOME and the national Housing Trust Fund as presumptively eligible under SLFRF. The guidance expands that list of programs to include an expanded range of federal programs from multiple agencies. Additionally, the new guidance clarifies that SLFRF may be used to finance the development, repair, or operation of any affordable rental housing unit that provides long-term affordability of 20 years or more to households at or below 65% of the area median income.

To support homeownership, recovery fund recipients can also offer down payment assistance, including contributions to a homeowner’s equity at origination or establishing a post-closing mortgage reserve account.

In North Carolina, the General Assembly adjourned the short session earlier this month with plans to return in November to reallocate the unspent State and Local Fiscal Recovery Funds. This new guidance from Treasury makes it possible for the funds to be used for LIHTC.