Frank Muraca is a Graduate Fellow at the Development Finance Initiative and a 2020 Master’s Candidate in UNC Chapel Hill’s Department of City and Regional Programming.

Frank Muraca is a Graduate Fellow at the Development Finance Initiative and a 2020 Master’s Candidate in UNC Chapel Hill’s Department of City and Regional Programming.

Since its creation in 1986, the Low-Income Housing Tax Credit (LIHTC) has become the largest source of new affordable housing in the nation, supporting the development of over three million affordable units nationwide and over 100,000 units in North Carolina. Each year, developers submit projects to the North Carolina Housing Finance Agency which scores applications against one another through a competitive process. Developers are awarded tax credits if they outperform other projects when scored by NCHFA’s Qualified Allocation Plan (QAP), which regulates where and how affordable units should be built.

Through the QAP, each states’ housing finance agency is given wide authority to set the terms for allocating these credits, and is an often-underappreciated policy document in conversations on how to address the affordable housing crisis. These requirements have a tremendous impact on how developers choose sites for affordable housing, and subsequently on where low-income renters will live. While each state’s QAP is different, North Carolina requires proposed LIHTC projects to be within a mile of a grocery store and shopping options, in Census tracts with relatively low poverty rates, and project costs below $80,000 per unit, along with other criteria.

How do these rules shape the location of North Carolina’s affordable housing? Could they make it more difficult to build in urban or suburban neighborhoods? Or prioritize greenfield over infill development?

While we know how developers can maximize their points in the QAP, we know relatively little about the effects of these rules on different localities. Let’s look at how one of the QAP’s top requirements – distance to amenities – could affect where affordable housing can be built using LIHTC.

North Carolina’s QAP requires projects to be within a mile driving distance from a grocery store, shopping center, and pharmacy (two miles if the project is located in a city with less than 10,000 people). The QAP also stipulates which businesses qualify as a grocery or shopping option. For example, Ingle’s Market and Food Lion qualify while gas station markets do not. It also specifies that only pharmacies that have “non-medical general merchandise items for sale” and are not located in a hospital can qualify.

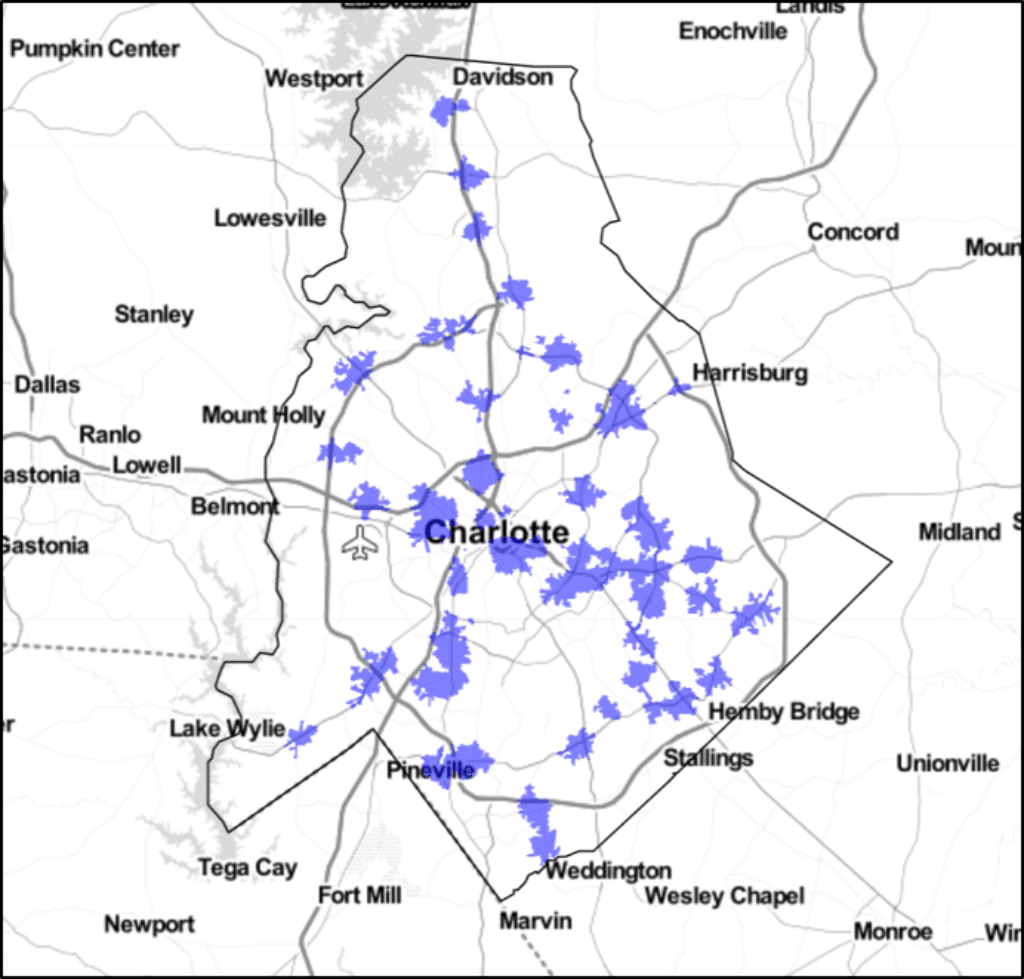

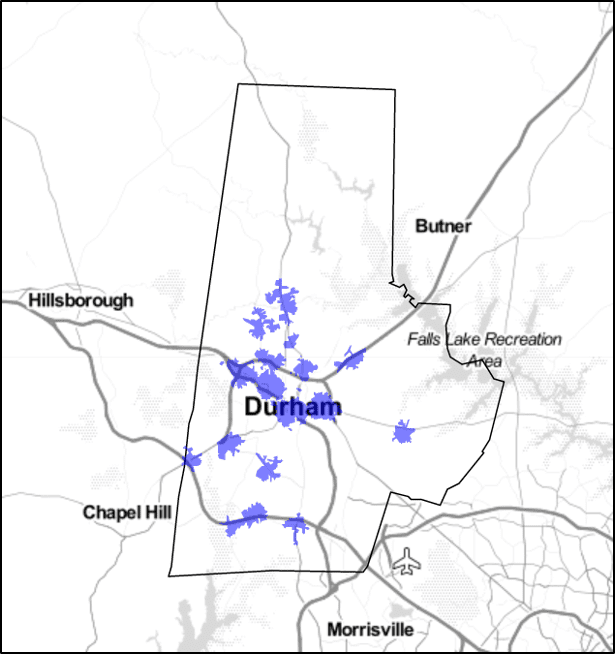

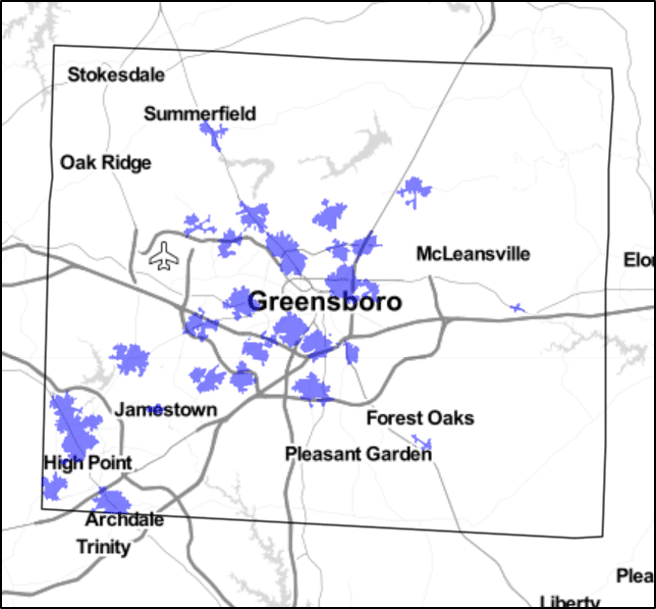

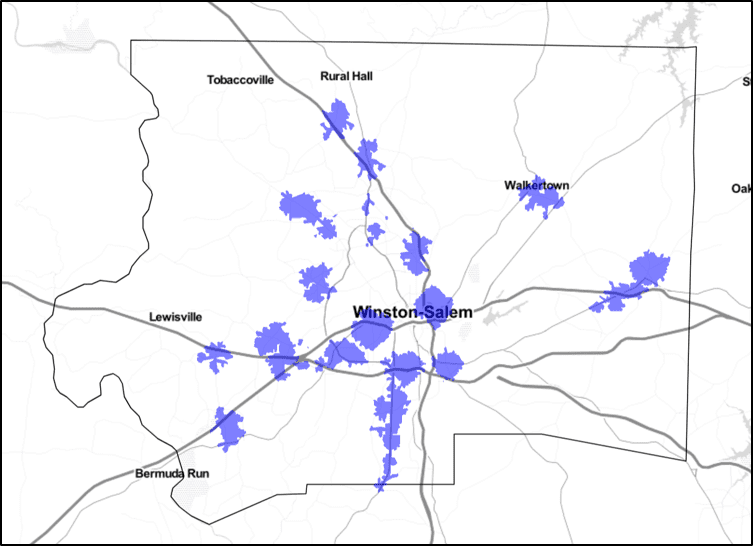

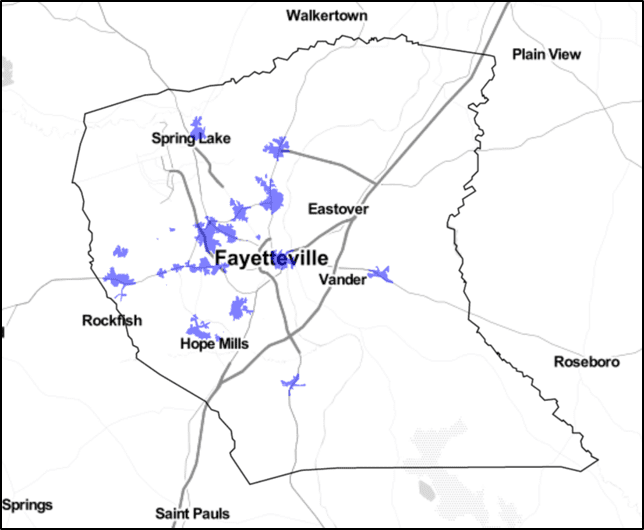

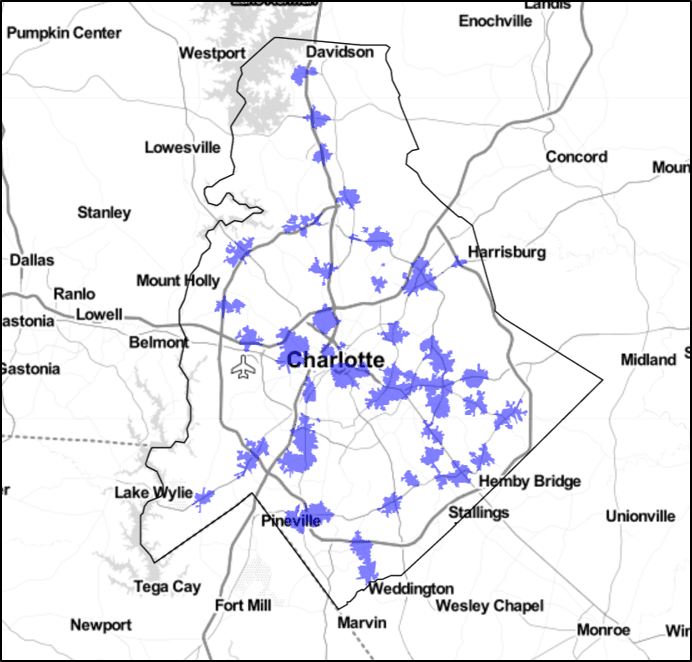

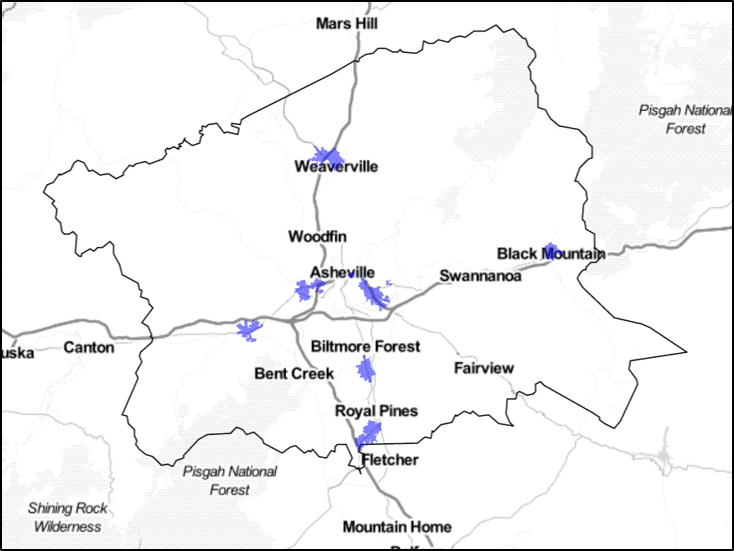

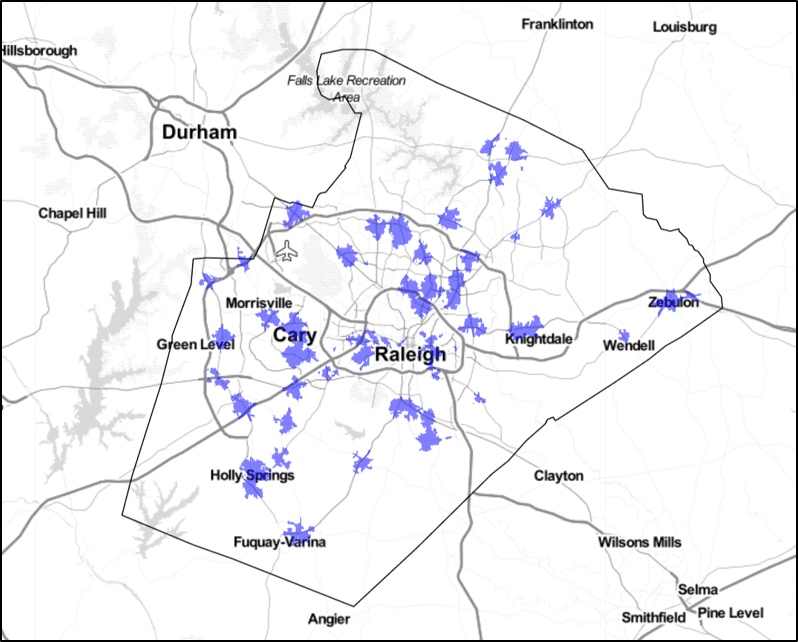

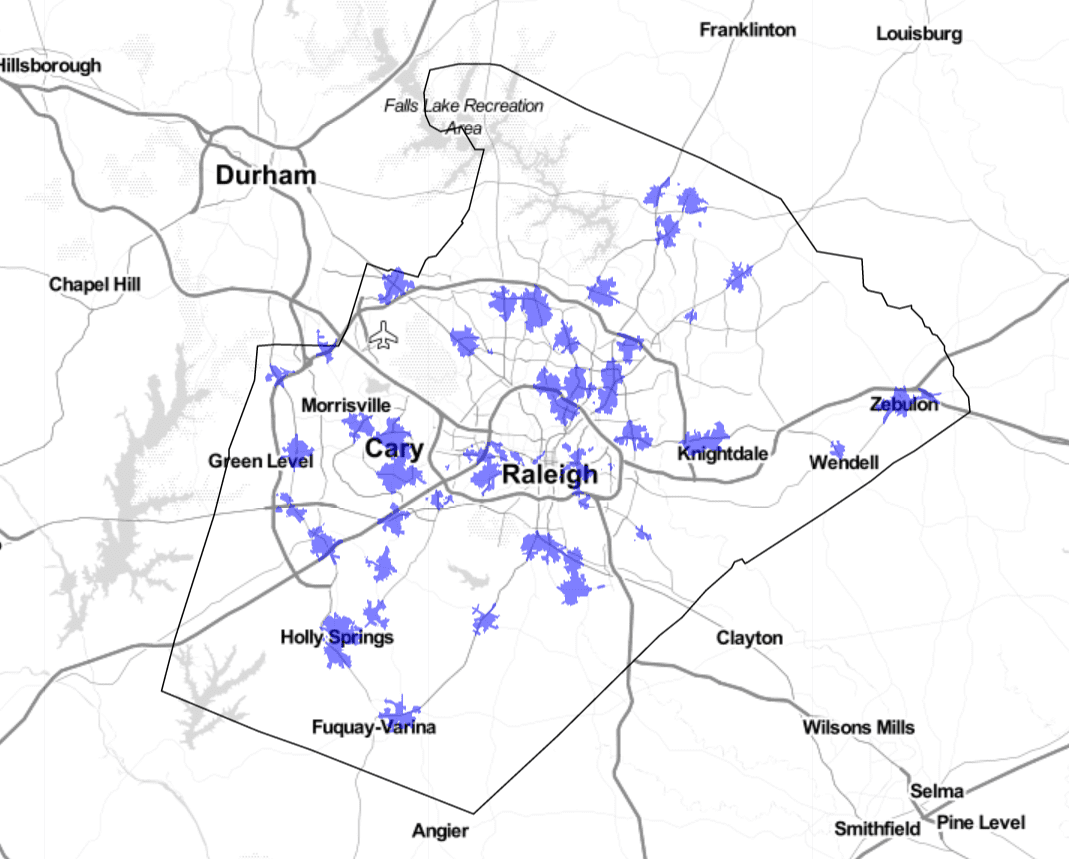

Where are the areas that are within a mile of all three of these amenities? When developers submit applications, they must provide a screenshot of Google maps showing that there proposed project is within a mile driving distance – rather than a mile radius – from these amenities. Using a 2017 dataset of all NC businesses, we can determine which areas would be within proximity of all three using GIS. For example, here are the predicted “competitive areas” for Wake County:

These are only predicted areas for a few reasons. Because the business location data is from 2017, it’s possible that a qualifying amenity has closed since then. It’s also possible that a qualifying amenity has opened that would expand the qualifying area. For example, in 2019 Weaver Street Market – a qualifying grocery – opened a branch in downtown Raleigh that might expand the competitive area. Additionally, amenities are not enough to receive full points under the QAP. Applications also lose points if they are near industrial sites, active railroads, or flood zones. It’s possible these dis-amenities could deduct points even if the project is close enough to the three amenities. For now, these are “predicted” competitive areas that are meant to provide a glance into the impact of this specific criteria.

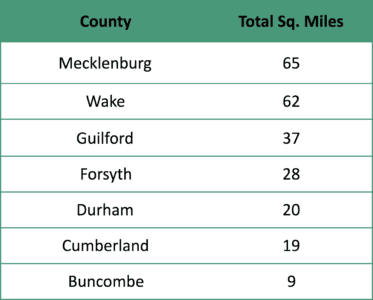

NCHFA reserves 38% of tax credits for metro counties, which include Buncombe, Cumberland, Durham, Forsyth, Guilford, Mecklenburg, and Wake. How are these different urban areas affected by statewide rules? From the predicted competitive areas described above, it’s clear that each county is impacted differently by the amenity score. In Mecklenburg, there are an estimated 65 square miles of competitive amenity area, but only 9 square miles in Buncombe.

Mecklenburg has a greater number of qualifying amenities, but it might also be a result of different road networks. A more interconnected road system would increase the acreage of land within a mile driving distance. It’s possible that Buncombe County’s more mountainous terrain affects the amount of land within a mile driving distance of these amenities. As a result, it might be more difficult for developers to find suitable sites for development.

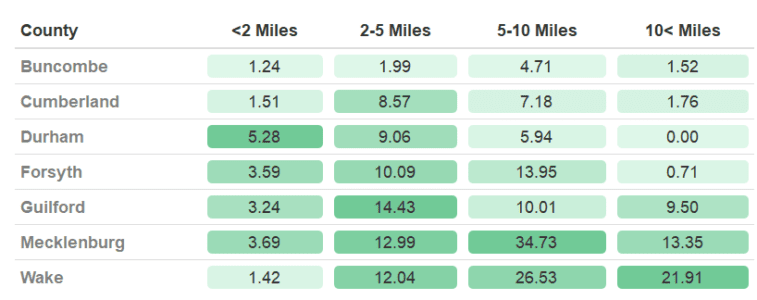

Could these rules affect the ability of affordable housing to be built in urban or suburban neighborhoods? By calculating the amount of competitive area by distance to downtown, we can get a better sense of where developers might look to find sites likely to be awarded credits. For example, there are over five square miles of competitive area within two miles of the City of Durham, but only 1.4 square miles within two miles of Raleigh. By comparison, there are over 20 square miles of competitive area over 10 miles from downtown Raleigh, but none that far from downtown Durham. Even as these rules affect each county differently, they are also unevenly distributed within the county themselves. This suggests that it might be more difficult to build urban affordable housing in some cities more than others.

An important aspect of the QAP is that each scoring criteria overlaps with one another. So not only do developers need to be within close proximity to amenities, but also consider other rules that might jeopardize the competitiveness of their applications. In addition to maximizing points, developers also consider the QAP’s tiebreakers which determine which applications are awarded credits if they were to receive the same number of points. While not all awards are chosen by the tiebreaker, it’s an important signal to developers in finding sites that would have the least amount of risk for rejection. In North Carolina, the first tiebreaker is decided by awarding credits to the project in the Census tract with the lowest poverty rate.

How might this tiebreaker affect the competitive amenity areas? If amenities are concentrated in high-poverty Census tracts, they might be less appealing as applications. This rule might also prioritize suburban sites if those high-poverty tracts are closer to downtown.

Looking at all metro counties together, a greater share of “urban” amenity areas are in census tracts with poverty rates greater than 10%. “Suburban” amenity areas on the other hand are disproportionately located in poverty rates less than 10%. This implies that even if a county has more land within a mile of amenities, those sites might be less desirable if they were to lose out to an application in a lower-poverty tract during a tiebreaker.

There are many reasons why affordable housing developments using LIHTC succeed or fail. Projects involve a wide range of actors – such as contractors, investors, and local governments – that could affect the final location of affordable units. During this process, the QAP is an important starting point for developers and has wide impacts on where tax credits can be used to finance construction. Based on the analysis above, some of North Carolina’s current requirements have different results for each of the state’s metropolitan areas and create more favorable conditions for suburban sites.