Last week, I met with a group of long standing homeowners living in a historically Black neighborhood in Durham who were shocked because they had just received their new property tax valuations from Durham County. The new tax values on their homes, built 75+ years ago and mostly still the original homes, had increased from around $70,000 to more than $240,000, an over 200% jump.

While the jump in tax value these homeowners experienced are particularly extreme, they are not an anomaly. On average, property tax values more than doubled in historically Black Durham neighborhoods, including Grant Street/Hayti, Crest Street, Southside, Old East Durham, West End/Lyon Park, and Merrick Moore.

With these new valuations in hand, many residents are rightly asking questions like:

- How will these new values impact their taxes?

- Are their new values– and values across their neighborhoods– fair?

- Should they appeal? What would make a strong appeal if so?

- What property tax relief is available? What else can we advocate for?

Over the next month, the Community Justice Collaborative will share tools and resources we have developed to support property tax justice and relief. These tools are designed to to increase equity and fairness of revaluations and to support long standing neighbors to mitigate the rising cost-burden of staying in their homes.

Our initial tools are focused on the Triangle. The Triangle has one of the fastest rising housing markets in the country, leading to significant property value increases in revaluation years. In fact, Durham’s new revaluation estimates a roughly 75% increase in total real property value county-wide, and Orange County’s new valuation estimates a 52% rise in real property value county-wide (Wake’s revaluation last year was similar). These revaluations will also lead to major shifts in the property tax burden between neighborhoods, resulting in neighborhoods with greater than average increases, like the historically Black neighborhoods above, paying a heavier portion of overall property taxes.

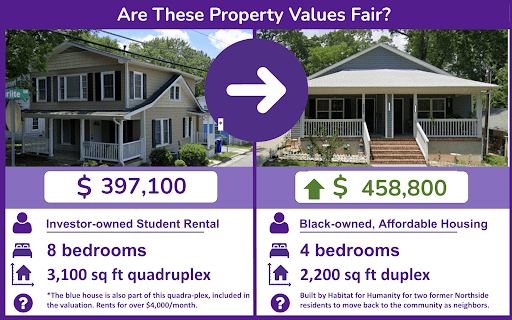

As I’ve written above before, recent North Carolina analysis (and national analysis) shows widespread overvaluation of lower income neighborhoods and communities of color – and much lower appeal rates from these same communities. Rapidly gentrifying neighborhoods are also particularly difficult to assess fairly, often resulting in the overvaluing and overtaxing of the older homes of long-term neighbors. Paired together, these can create large and potentially unjust increases in property taxes that can further drive displacement of long standing residents.

While some of the tools will focus on Triangle counties, most of the broader resources should be relevant to residents across the state of North Carolina. Our hope is to expand the tools to other counties over the next few years with neighborhood based partners across the state.

In the coming weeks, we’ll share our new tools and resources:

- JUST RELEASED: Property tax calculator that estimates your change in property taxes based on your new valuation (and a range of tax rates from “revenue neutral” to the most common rates set in revaluation years)

- Resource to help you spot assessment problems in gentrifying neighborhoods

- Analysis of assessment fairness in neighborhoods in Durham and Orange Counties

- Tips for appealing your property tax valuation

- Advocacy tools for improving property tax relief programs

Upcoming Property Tax Justice Workshops

The NC Housing Coalition’s Community Justice Collaborative is also partnering with neighborhood-based organizations to host property tax justice workshops across the Triangle in April and May to share these tools directly with impacted neighbors.

Here are a few of our upcoming property tax justice workshops:

- Merrick Moore (Durham) Workshop – Monday, April 21 @ 7 pm

- Rogers Road (Orange County) Workshop – Tuesday, April 22 @ 5:00 pm

- Cedar Grove (Orange County) – Thursday April 24 @ 5 pm

- Hillsborough/Piney Grove (Orange County) – Thursday April 24 @ 7 pm

- Walltown (Durham) – Saturday April 26 @ 10:30 am

Contact us at propertytax@nchousing.org if you are interested in partnering, volunteering, or participating or have feedback or questions about any of these resources.