by Stephanie Watkins-Cruz and Anna Patterson

The National Low Income Housing Coalition has released the 2024 Out of Reach (OOR): The High Cost of Housing report. This annual report is filled with important data that highlights the gap between wages and cost of housing across every state, county, non-metropolitan area, and metropolitan area across the United States. One key metric that this report contains is the “Housing Wage,” which is an annual estimate of the hourly wage full-time workers must earn to afford a rental home at fair market rent without spending more of their incomes.

National Housing Wage

According to this year’s report, the national housing wage is $32.11 for a modest 2-bedroom rental, and $26.74 for a modest 1-bedroom rental home.

- California has the highest state housing wage: $47.38

- North Dakota has the lowest state housing wage: $18.38

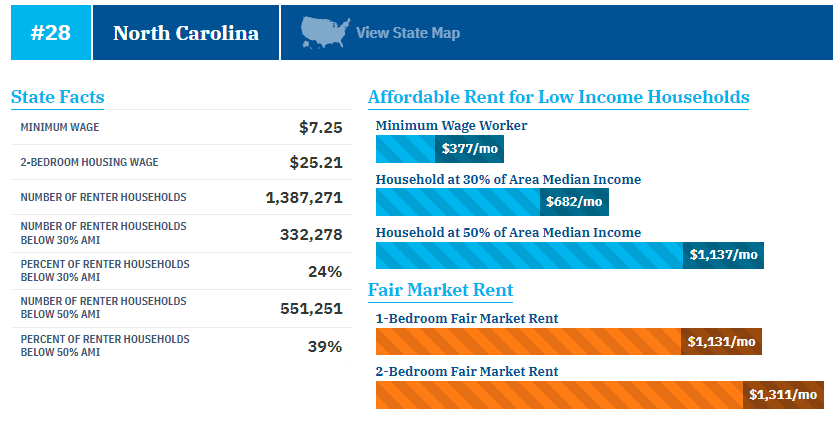

Housing Wages in North Carolina

This year, the housing wage for our state is $25.21, which is an increase from last year’s housing wage of- $21.54. North Carolina is now ranked 28th (1 being the highest wage, 50 being the lowest) for its 2 Bedroom Housing Wage when compared to other states.

A housing wage of $25.21 means that someone earning minimum wage in North Carolina ($7.25/hr) would have to work at least 139 hours per week to afford a 2-Bedroom Rental Home at Fair Market Rent (FMR), or 3.5 full time jobs. In order to afford a 1-Bedroom rental home at FMR, a full-time worker earning minimum wage in North Carolina would have to work at least 120 hours per week and hold 3 full time jobs.

The most expensive areas in our state and their housing wages include:

| Most Expensive Areas in NC | Housing Wage |

| Asheville HMFA | $32.31 |

| Raleigh MSA | $31.65 |

| Durham-Chapel Hill HMFA | $31.37 |

| Charlotte-Concord-Gastonia HMFA | $29.88 |

| Wilmington HMFA | $29.13 |

View the full North Carolina Out of Reach page

View the full North Carolina Out of Reach page

In addition to this key metric which many of you may recognize from our County Profiles, the report gives readers several takeaways:

- Cost-burdened families are left with less money for other basic needs like healthcare, transportation, food, and childcare. Simply put, renters spending more than 30% of their income on rent and utilities aren’t left with enough of their paycheck to cover the other basic necessities.

- We continue to experience the long-term loss and systemic shortage of affordable housing. There aren’t enough affordable units available to meet the scale of the need. Compounding this problem, affordable rental construction cannot keep pace with the number of affordable units lost each year.

- The high cost of housing impacts some communities more severely than others. As a result of wage disparities, Black and Latino workers face larger gaps between their wages and the cost of rental housing than white workers. Women also face wage disparities that make it difficult to access housing, and these inequities are only further amplified for Black and Latina women.

- Criminalizing homelessness while rents are out of reach is counterproductive. Ticketing, fining, and arresting people for not having a home only hinders their ability to access services needed. Congress must address the homelessness crisis by embracing Housing First – the most effective approach for reducing homelessness.

- Federal policies and resources play a pivotal role in establishing a robust housing safety net. Congress must provide long-term support to extremely low-income families by making substantial investments in deeply targeted affordable housing programs like Housing Choice Vouchers, the national Housing Trust Fund, and Public Housing. Strengthened tenant protection policies and policies that embrace the Housing First approach are also critical in promoting housing stability and reducing homelessness.

We’ll continue to analyze the North Carolina OOR data over the next few weeks. For additional information and to download the report, visit: http://www.nlihc.org/oor