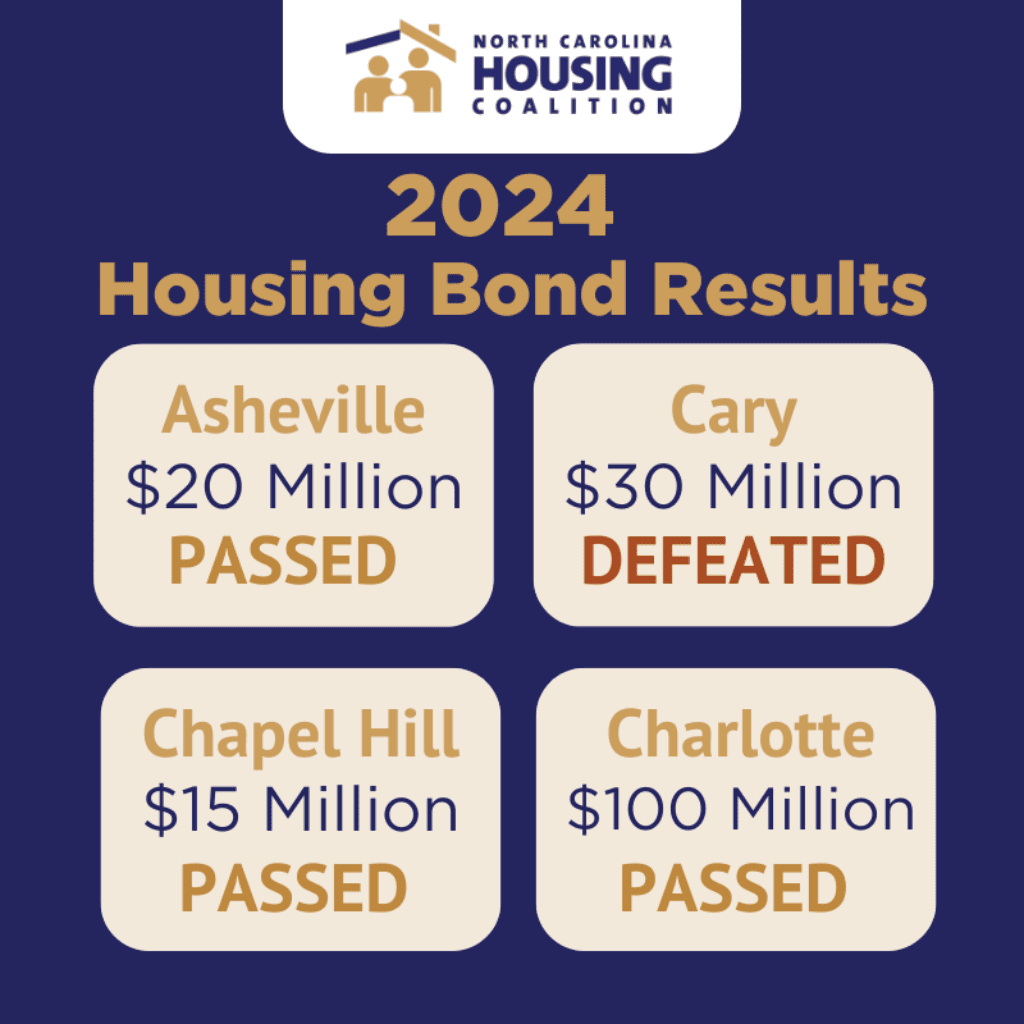

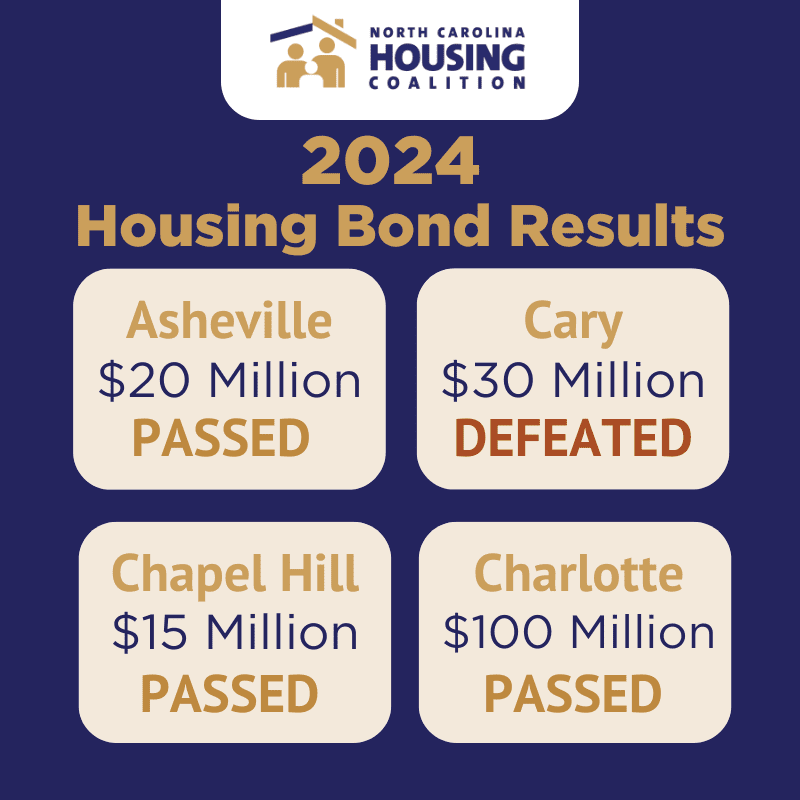

This week, three growing NC communities voted to approve housing bonds, while a fourth bond was defeated by a narrow margin. When federal and state funding is limited, housing bonds can be a key source of funding for towns and cities, especially those who are experiencing rapid growth–resulting in a rapid rise of housing costs.

City of Charlotte

Charlotte’s housing bond was the biggest on the ballot in North Carolina. The multifaceted $100 million bond included funding for rental housing and homeownership opportunities ($35 million), anti-displacement and rental preservation ($14 million), supportive housing and shelter capacity ($9 million), and rehab and emergency repairs ($5 million). The bond passed with 63.6% voting in favor of the referendum, while 36% voted against.

City of Asheville

Asheville’s $20 million housing bond was prepared for the ballot prior to the devastating impacts of Hurricane Helene. A recent analysis estimates more than $14 billion worth of damage to Western NC’s housing stock, including areas of Asheville that experienced heavy flooding. Fortunately, election officials worked quickly to ensure record voting turnout for the region, and Asheville overwhelmingly passed the referendum with 70.9% voting in favor and 27.1% voting against.

Town of Chapel Hill

With more than half of Orange County renters paying more than a third of their incomes on rent, Chapel Hill’s $15 million housing bond also received a wide margin of approval, with 72.9% voting in favor and 27.1% voting against.

Town of Cary

Cary was the only NC community in this year’s election that did not approve a housing bond on the ballot. The $30 million housing bond was part of a larger $560 bond proposal that primarily included funding for the town’s parks. The ballot was defeated by a narrow margin, with 51.5% voting against the referendum, 48.5% voting in favor.

It’s clear from this year’s election results that communities across the state are open to housing bonds as a source of funding for affordable housing initiatives that include improving Supply, Stability, Subsidy, and Systems. With newly elected representatives in cities and towns across the state, 2025 will be a key year for starting new housing bond initiatives in North Carolina.