This morning, the North Carolina Senate approved the Senate’s proposed state budget (SB 105). The Senate proposes a total spending budget of $25.7 billion in the Fiscal Year 2021-2022 and $26.6 billion for Fiscal Year 2022-2023. For housing programs, the Senate’s proposal invests much less funding into housing than what Governor Roy Cooper called for (Cooper recommended investing over $575 million in ARPA funds to affordable housing needs.) In addition, the Senate’s proposal includes statutory and procedural changes for the North Carolina Housing Finance Agency, including changes for the Qualified Allocation Plan which details how the state’s Low-Income Housing Tax Credits are allocated every year.

The Republican-controlled Senate voted 32-17, with enough support from Democrats to override a potential veto from Democratic Gov. Roy Cooper. The budget bill now moves to the House which will begin Appropriations hearings. With the July 4th holiday around the corner it is likely that the House passes a budget in mid-July.

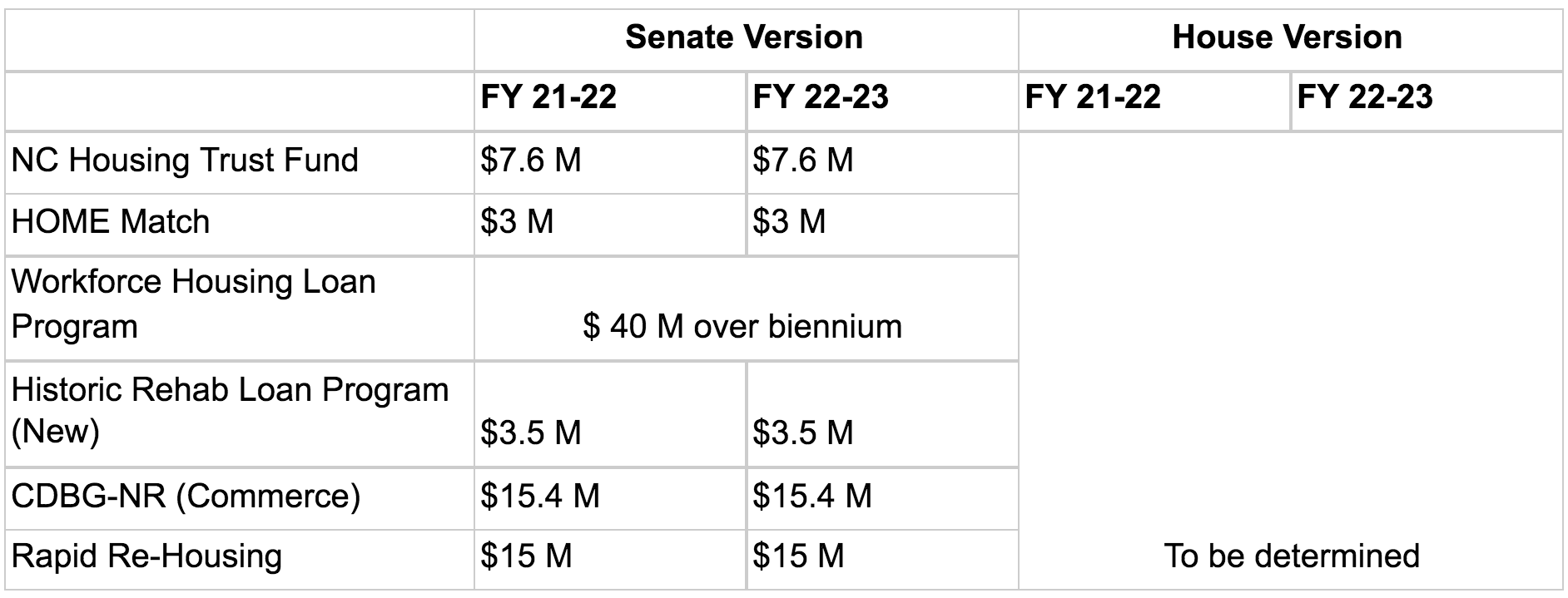

For housing, the Senate’s proposed funding amounts are listed below:

Some of the most concerning proposed changes regarding NCHFA are detailed below:

- Section 29.1(a)- Study Modifying the QAP

- Requires NCHFA to study potential changes to QAP amenity scoring, including:

- Eliminating, deprioritizing, or redefining the “shopping”, “grocery”, and “pharmacy” categories.

- Removing the distinction between primary and secondary amenities.

- Establishing a scoring threshold for amenities & measures of opportunity.

- Removing the cap on construction costs for historic rehabs.

- Requires NCHFA to study potential changes to QAP amenity scoring, including:

- Section 29.1(c)-(e)- 10% QAP set-aside for historic/downtown LIHTC developments

- Creates a new 10% set-aside for historic rehabs or projects within downtown “central business districts” or similarly designated areas

- Creates new $3.5 M/year funding program for such developments

- Section 29.2(a)(1)-(5)- Changes to budgeting procedures

- Requires Finance Agency to make changes to its accounting systems & procedures

- Section 29.2(c)-(d)- Statutory changes for HFA relating to the State Budget Act

- Language change to NCHFA’s statutory enabling language

- Section 29.3(a)-(4)- Additional public hearing/publishing rules for HAF

- Requires a public hearing and publishing rules in the North Carolina Register at least 30 days prior to adopting or amending procedures to the Homeowner Assistance Fund

This additional requirement for the implementation of the Homeowner Assistance Fund is the most concerning in the near-term. The US Treasury Department guidelines already require detailed public input (NCHFA’s comment period for its draft HAF plan ended two days ago). This new requirement, if passed, would potentially delay the opening of this assistance program, potentially worsening the financial harm already being experienced by tens of thousands of homeowners across the state. The delay also increases the cost absorption that mortgage servicers and investors have been shouldering.

The Coalition is also concerned about the long-term effects of legislative mandates to the QAP and housing credit allocation process. As has been seen in other states, such a precedent could pave the way for increased legislative mandates, set-asides, and potentially a play-to-play system.

Please contact NC House members to voice your concerns over these provisions. Ask that they remove these harmful provisions from the state’s budget. Go here to contact your representatives.