The gold standard in determining housing affordability is the 30% rule. We all know it – Housing costs are affordable if the household is spending no more than 30% of its income on it. It is so baked into our collective consciousness that everyone uses it. Lenders use it to underwrite mortgage loans. Developers use it to set rent prices. Governments use it to determine subsidies. If you take a financial literacy class or download a budgeting template from the internet, it will use the same formula. Our policy and advocacy partner, the National Low Income Housing Coalition, uses the rule to determine if a household is “cost burdened” by their housing costs. If you read Matthew Desmond’s Evicted (if you haven’t, what are you waiting for), you will remember how dramatically a renter’s life changed once he was able to secure an apartment where the rent was subsidized to 30% of his income. The rule is beautiful in its simplicity. Right?

Maybe not. Increasingly, the rule may not be the best way to calculate housing affordability. A uniform housing cost-to-income ratio ignores the different financial capabilities among families of varying incomes, sizes, and types. It is why, as an advocate, you get that frustrated feeling when someone says to you “All housing is affordable housing to someone, isn’t it?”.

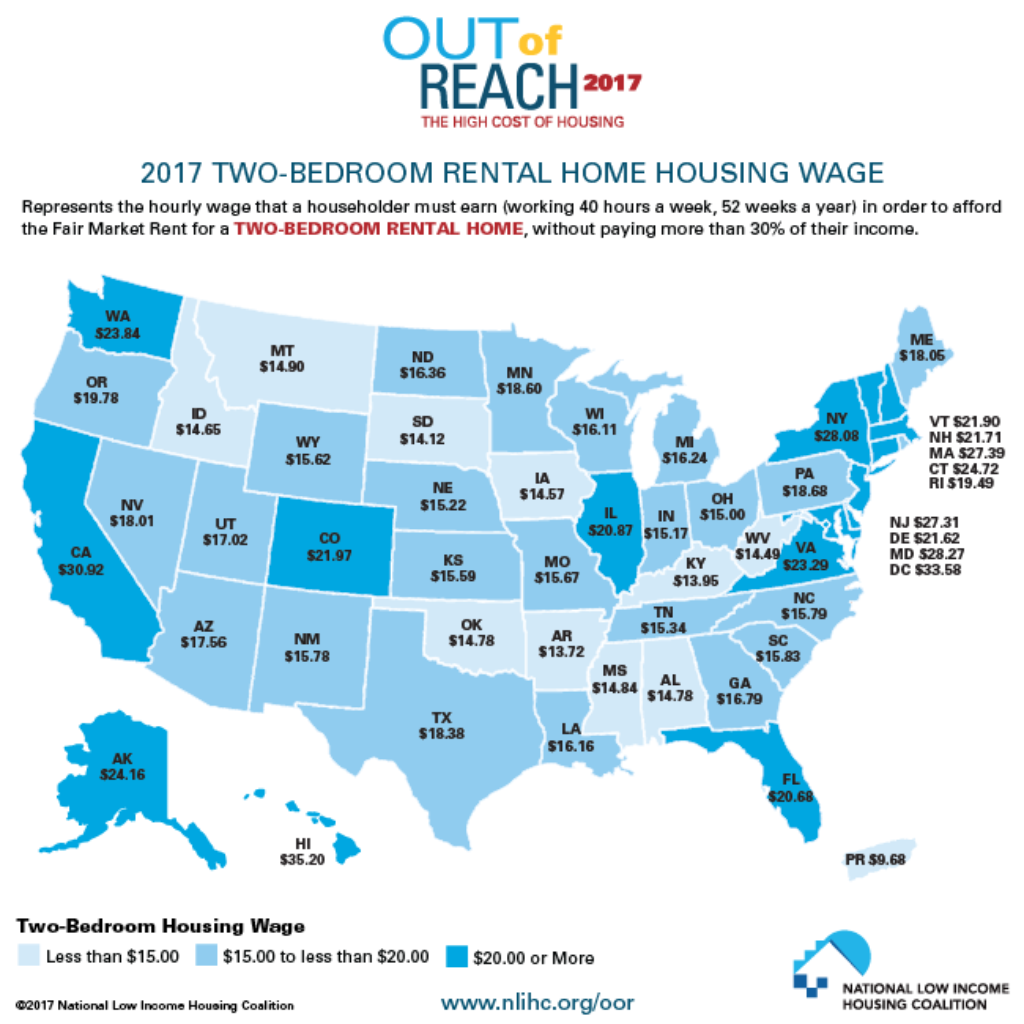

Let’s look at a quick example: As a single parent of two children, you work at a supermarket in Raleigh and bring home about $1600/month ($10/hr). Housing is not affordable for you near the supermarket, so you live a few miles away and pay $500/month for an older apartment. You live in NC, where public transit is inconsistent at best, so you have a car which costs you about $300/month. That leaves you with about $900/month left, which dwindles pretty quickly if you pay $546/month for groceries (the USDA average for a low cost meal plan), personal care, childcare, healthcare, and other incidentals. And if you get sick or your car needs repairs, you have even less money left over.

Now, let’s say you are a single person with no children working as an executive at a technology firm downtown bringing home about $8000/month. You’re hip and cool so you live downtown and pay about $3000/month in rent for a new loft apartment. Since you are within walking distance of work and you live on one of the few transit lines in Raleigh, you buy a $100/month bus pass. That leaves you with about $4900/month in disposal income to eat out and travel.

Three issues are crucial in today’s housing market: Equity, Location-related costs, and Housing quality.

Yet, if we use the 30% rule, the technology executive is housing cost burdened while the supermarket employee is not. While the examples may seem stark, the reality is that as the need for affordable housing grows, the ways we talk about housing affordability need to change. The 30% rule ignores three issues that are crucial in today’s housing market:

- Equity – the 30% rule doesn’t take into account that some households 70% is a much larger number in real dollars than others

- Location related costs – Housing costs are very closely tied to other location costs. Chief among those other costs is transportation, which can be huge if you live in an area where you need to maintain a vehicle to go to work.

- Housing quality – Housing costs are also often tied to the quality of housing. For many households, their housing is made affordable by being substandard.

So, what would be a better way to think about housing affordability? Many of us already anecdotally know the concept of being “housing poor”. However, that is a real concept called the “residual income approach”. In the residual income approach, the costs of basic necessities is deducted from a households income before including housing costs. In that approach, the supermarket employee above would have no money left for housing and would be considered in “shelter poverty”. Learn more about the residual income approach here.

Work with us at NCHC to move toward a policy based approach that talks about housing affordability and in addition to the need for more actual units of affordable housing. Join today!